📈 Understanding Market Systems: How Goods, Services, and Money Interact

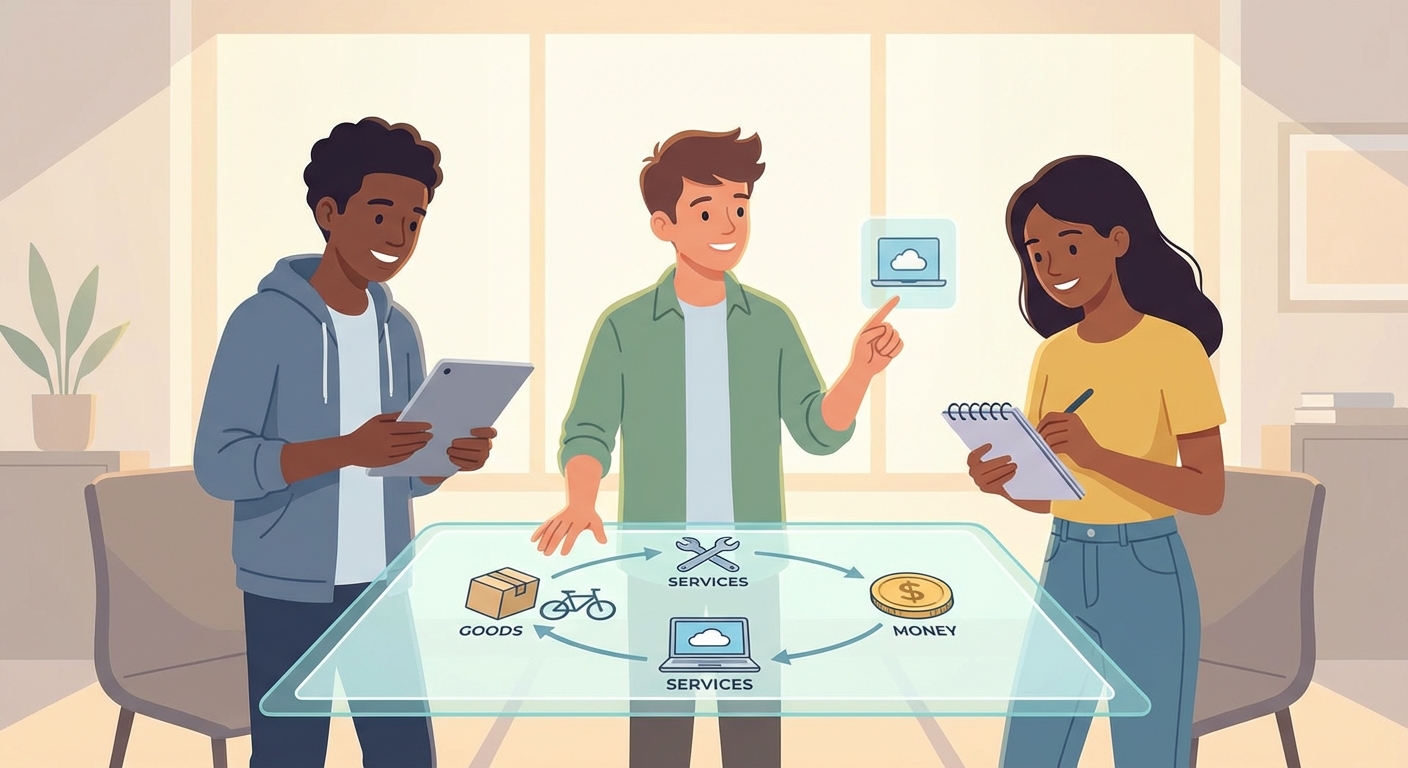

A market system is a network of buyers, sellers, and institutions that coordinate resource allocation through price signals, incentives, and voluntary exchange. Grasping its mechanisms equips teenagers with the analytical tools needed for informed citizenship and future careers in economics, business, or public policy.

1. The Core Mechanics of Supply, Demand, and Price Formation

- In a competitive market, producers offer quantities of goods at prices they deem profitable.

- Consumers simultaneously decide how much to purchase based on personal preferences and income constraints.

- The intersection of the supply curve and the demand curve determines the equilibrium price and quantity.

- When a sudden shortage occurs, prices rise, prompting firms to increase production or new entrants to appear.

- Conversely, a surplus triggers price declines, encouraging consumers to buy more while firms cut output.

- This self‑correcting process, known as the “invisible hand,” was first described by Adam Smith.

- Empirical research from the National Bureau of Economic Research confirms that price adjustments occur within days in liquid markets.

- Understanding these dynamics prepares students for careers as market analysts, where real‑time data interpretation is essential.

2. Multiple Perspectives: Consumers, Producers, and Government

- Consumers prioritize utility, seeking the greatest satisfaction per dollar spent while considering ethical concerns.

- Producers focus on profit maximization, balancing production costs against expected market prices.

- Governments intervene to correct market failures, such as externalities, monopolies, or information asymmetries.

- For example, carbon taxes internalize environmental costs, aligning private incentives with societal welfare.

- Researchers at Harvard Business School have demonstrated that transparent labeling influences consumer choices dramatically.

- Policy analysts evaluate the trade‑off between regulation benefits and potential reductions in entrepreneurial dynamism.

- Careers in regulatory affairs require the ability to synthesize stakeholder viewpoints into balanced legislation.

- By examining case studies like the 2008 financial crisis, students see how neglecting multiple perspectives can destabilize entire economies.

3. Market Structures and Their Real‑world Implications

- Perfect competition assumes many small firms, homogeneous products, and free entry, rarely existing in practice.

- Monopolistic competition features differentiated products, allowing firms to set prices above marginal cost.

- Oligopolies consist of few dominant players whose strategic interactions shape industry outcomes.

- Pure monopolies control entire markets, often leading to higher prices and reduced consumer surplus.

- Empirical studies in the Journal of Industrial Economics illustrate how telecom oligopolies affect pricing innovation.

- Understanding these structures guides career paths in antitrust law, where lawyers assess competitive harms.

- Market researchers employ surveys and econometric models to classify industries accurately.

- Analyzing structural differences helps future entrepreneurs decide whether to enter niche markets or compete broadly.

4. Globalization, Technology, and the Future of Markets

- Digital platforms such as Amazon and Alibaba have transformed traditional supply chains into instantaneous, data‑driven networks.

- Blockchain technology promises decentralized markets, reducing transaction costs and enhancing transparency.

- Researchers at MIT have quantified how algorithmic pricing can both improve efficiency and exacerbate inequality.

- International trade agreements reshape comparative advantages, influencing which countries specialize in specific industries.

- Careers in fintech demand fluency in both economic theory and computer science, bridging two rapidly evolving fields.

- Sustainable market design increasingly incorporates circular‑economy principles, encouraging reuse and recycling.

- By studying these

By studying these developments, students can anticipate how markets will evolve and prepare for emerging career opportunities.

Understanding market systems empowers you to make informed choices as consumers, creators, and citizens.

Quiz: Test Your Knowledge

-

Which of the following best describes a market where many firms sell similar but not identical products?

a) Perfect competition

b) Monopolistic competition ✓

c) Oligopoly

d) Pure monopoly -

What is the primary purpose of a carbon tax?

a) To raise government revenue only

b) To internalize environmental costs ✓

c) To subsidize fossil fuel companies

d) To eliminate all carbon emissions -

Which technology is most associated with creating decentralized markets?

a) Cloud computing

b) Blockchain ✓

c) 5G networks

d) Virtual reality -

In an oligopoly, firms are most likely to:

a) Ignore each other’s pricing decisions

b) Coordinate informally to set prices ✓

c) Have no market power

d) Offer identical products at the same price